S3studio/Getty Images

- Shares of Spotify fell on Wednesday after a muted outlook offset subscriber growth.

- The company expects revenue of between €9.01 and €9.41 billion in 2021 vs. a €9.57B consensus estimate.

- Spotify ended the quarter with 155 million premium subscribers, beating analyst estimates.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Shares of Spotify fell on Wednesday after the music streaming giant gave a conservative outlook for 2021 despite posting strong subscriber growth in its earnings release.

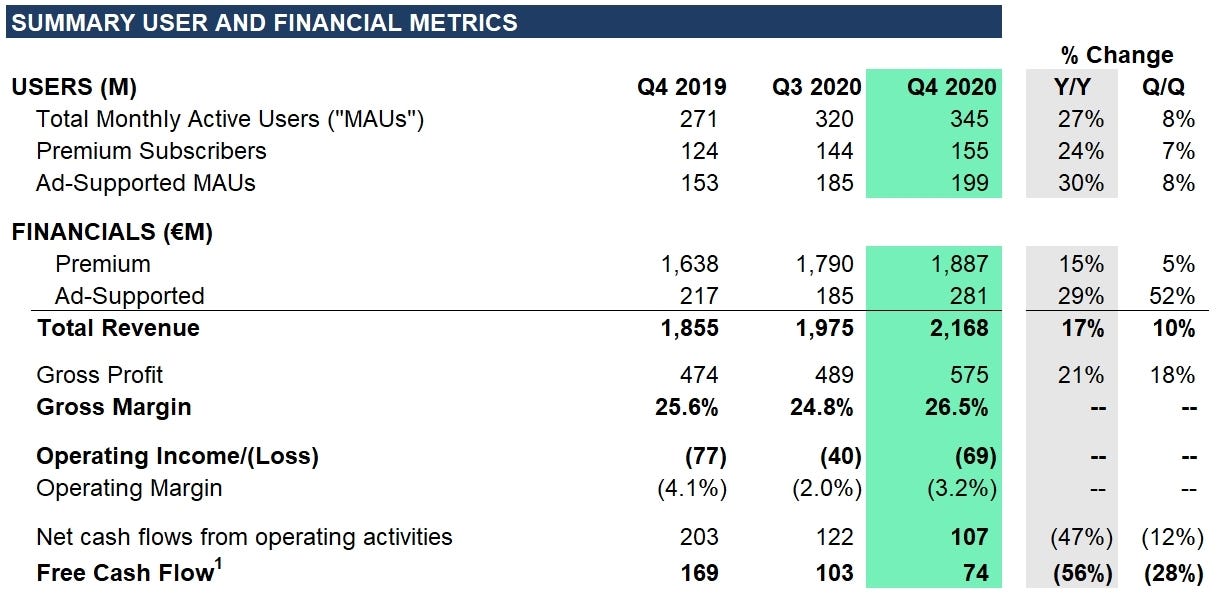

Spotify was able to add 11 million paying subscribers in its most recent quarter, beating analyst estimates of 9 million. The company now boasts 155 million premium subscribers worldwide along with 345 million total monthly active users, a figure that jumped 27% year-over-year.

Still, despite the strong subscriber growth, Spotify stock is down on Wednesday due to the company’s tepid outlook for 2021.

For Q1, Spotify expects revenue of between €1.99 and €2.19 billion versus a consensus estimate of €2.20 billion from analysts. And for the full-year 2021, Spotify expects revenue to be between €9.01 and €9.41 billion vs. a €9.57B consensus estimate from analysts.

Spotify also continued to struggle with profitability in its most recent quarter. The company posted operating losses of €69 in the quarter that ended in December, losing €0.66 per share, and missing EPS estimates by €0.11.

The Stockholm-based company said it expects the losses to continue as well, forecasting a €300 to €200 million operating loss for 2021.

Of course, there were some bright spots at Spotify during the quarter in addition to subscriber growth. Revenues were up 17% year-over-year and beat analyst estimates, while gross margins came in at 26.5% vs. the 25.6% consensus estimate. Unfortunately, free cash flow was weaker than expected down 56% year-over-year for the quarter.

Spotify

Spotify highlighted its new content acquisitions, international expansion, and deals with Grab, Flipkart, Tink, and Euronics as drivers of growth moving forward.

Still, the company said it "faced increased forecasting uncertainty versus prior years due to the unknown duration of the pandemic and its ongoing effect on user, subscriber, and revenue growth."

Despite the weak guidance, analysts are mostly bullish on Spotify for now. The company boasts 14 "buy" ratings, seven "neutral" ratings, and just five "sell" ratings from analysts.

Shares traded down 7.94% at $318.02 as of 9:42 AM EST on Wednesday.